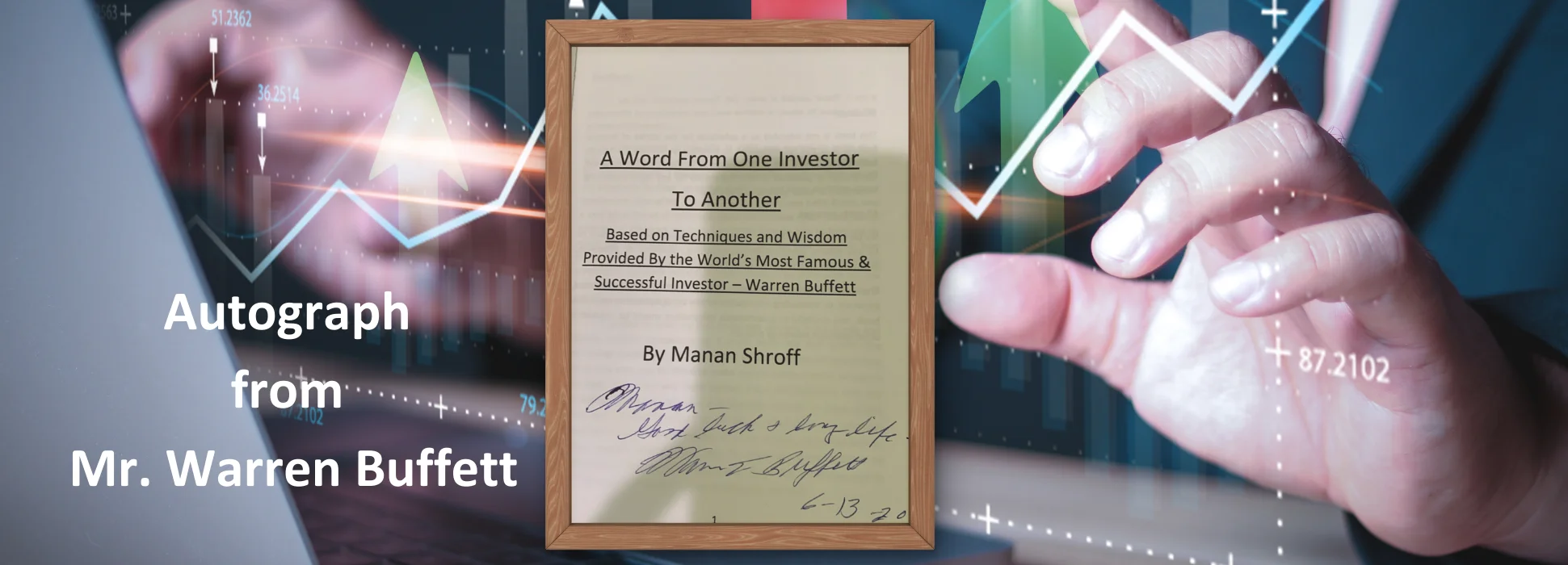

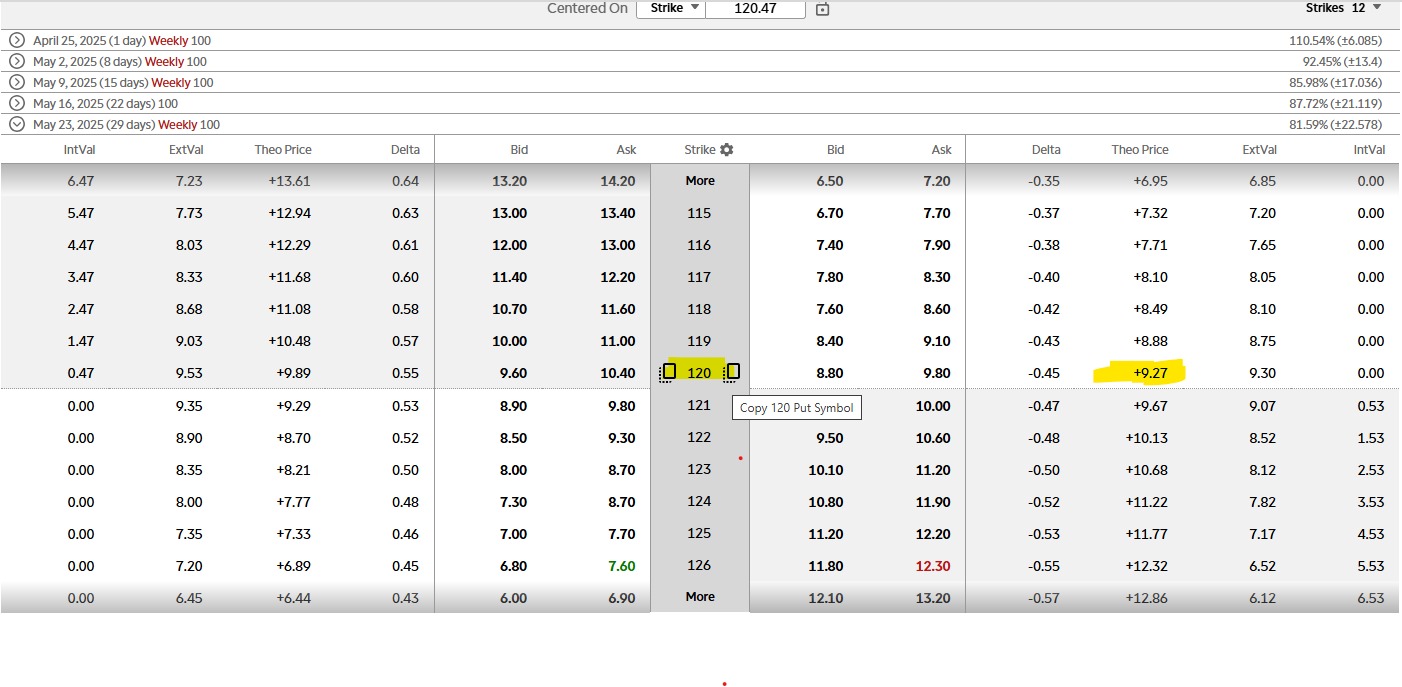

A 3x leveraged ETF (Exchange-Traded Fund) aims to deliver three times the daily return of a specific index or benchmark. For example:

If the S&P 500 index increases by 1%, a 3x leveraged ETF designed to track this index would ideally return +3%. Conversely, if the S&P 500 decreases by 1%, the ETF would lose 3%. This amplification of returns is achieved through the use of financial derivatives and borrowing, allowing the fund to invest more than it holds in assets.

These stocks, combined with covered call premiums, provide good returns in 2025.

C, HPQ, HPE, PFE, CI, EXPE, PYPL, XOM, CVX, BMY, EBAY, COF, DFS, MDT, CNC, CMCSA, ELV, BIIB, TROW, DHI, SIG, FFIV, SBUX, NKE, BLDR, MDT, HPE, BBY, CAH, SNA, ULTA, DBX, GILD, ABNB, CNXC, CHRD, SLB, HAL, GIS, VLO, CROX, HSY, HUM, AMGN, MRK, BIIB, KHC, BALL, PEP, BP, SLB, HAL, DHI, PHM, OC, LEN, MHI, CSCO

These stocks trade at high valuations and offer high risk but also potential high rewards.

NVDA, MSFT, AVGO, AMZN, AAPL, CRM, AMAT, LRCX, TWLO, PLTR, PANW, CHWY, TSM, NVO, TXN

Writing covered calls on these stocks can provide better returns.

UNH, DELL, WSM, Meta, GOOG, QCOM, DIS, CSX, DOCU, ZOOM, V, HON, JNJ, GEHC, GSK, GIS, KHC, KMB

Do not exceed 2% in any individual stock and 15% of the total portfolio.

TSLA, UBER, MSTR, CMG, CHWY, PLTR, OKTA, ONON, SOUN, TSLA, MARA, IONQ, RGTI, PATH