How 2x or 3x Leverage ETFs Works

KNOW AND UNDERSTAND BEFORE INVESTING:

A 3x leveraged ETF (Exchange-Traded Fund) aims to deliver three times the daily return of a specific index or benchmark. For example:

If the S&P 500 index increases by 1%, a 3x leveraged ETF designed to track this index would ideally return +3%. Conversely, if the S&P 500 decreases by 1%, the ETF would lose 3%. This amplification of returns is achieved through the use of financial derivatives and borrowing, allowing the fund to invest more than it holds in assets.

Index on Up Day.

- An index that starts at 100.

- A 3x leveraged ETF that starts with $100, designed to move three times the index.

- The index borrows money to maintain exposure to $300 worth of assets (3x the index)

- On day one, the index rises from 100 to 105 (+5%), the 3x ETF gains 15%, with a new value of $115. Under the daily reset, the ETF must now control $345 worth of assets (3 x $115), because it must maintain three times the fund's total assets in exposure to the index. So it buys another $45 of exposure.

Index on Down Day.

- The index falls 5% (the same percentage as the previous day's rise), from (105*0.05 = 5.25, 105-5.25 = 99.75) 105 to 99.75.

- The 3x ETF should lose 15%, so its value drops from $115 to $97.75.

- So since the start of trading on day one, the index has gone up 5% then down 5%, yet lost 0.25% of its overall value. Meanwhile, the 3x ETF has gone up 15% and down 15%-but lost 2.25% (115 * 0.15 = 17.25, 115 - 17.25 = 97.75) of its original value.

Then why I am investing?

- I am able to digest any volatility. If I looses more than 70% of market value, I would not have panic attack and therefore I will not sell in panic with loss.

- I am mostly sticking to major indexes. In order to loose all my money in one ETF, index needs to drop 30% in ONE DAY. Very unlikely event but can happen.

- My main purpose to own this fund is to use its volatility to extract maximum premium.

- I am planning to invest slowly 5 to 10% of my total portfolio cost. I will never exceed than 10% under this category.

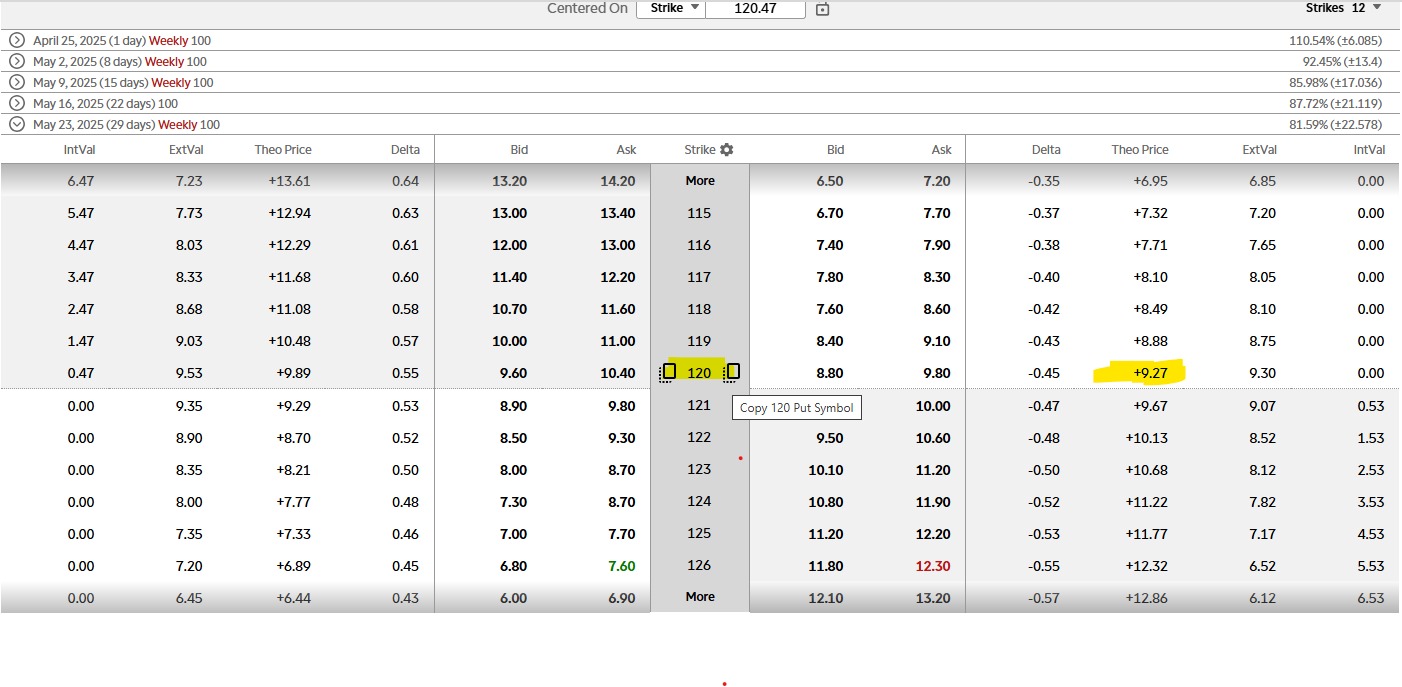

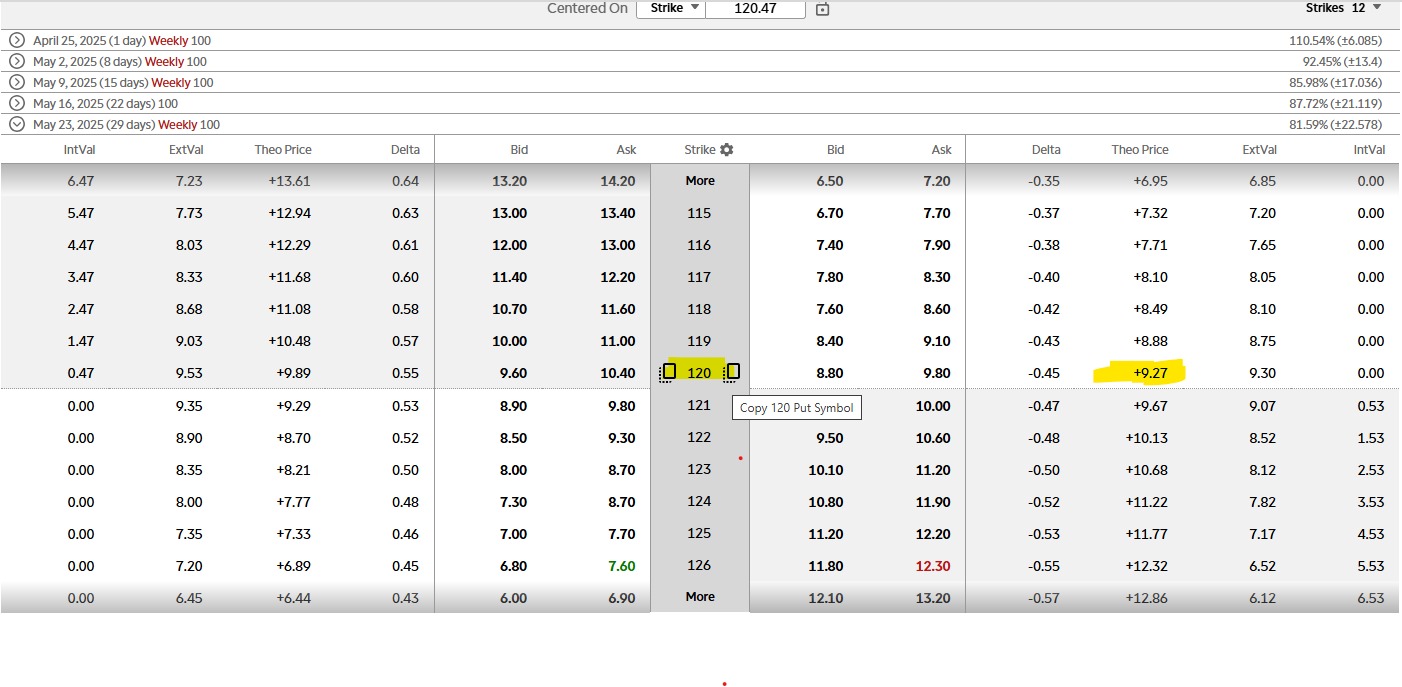

Live example with SPXL.

- Starting with one month PUT which I usually write at delta 50. Strike price is $120 and premium price is $9.25. The rate of return for a month is 9.25/120 = 7.7%

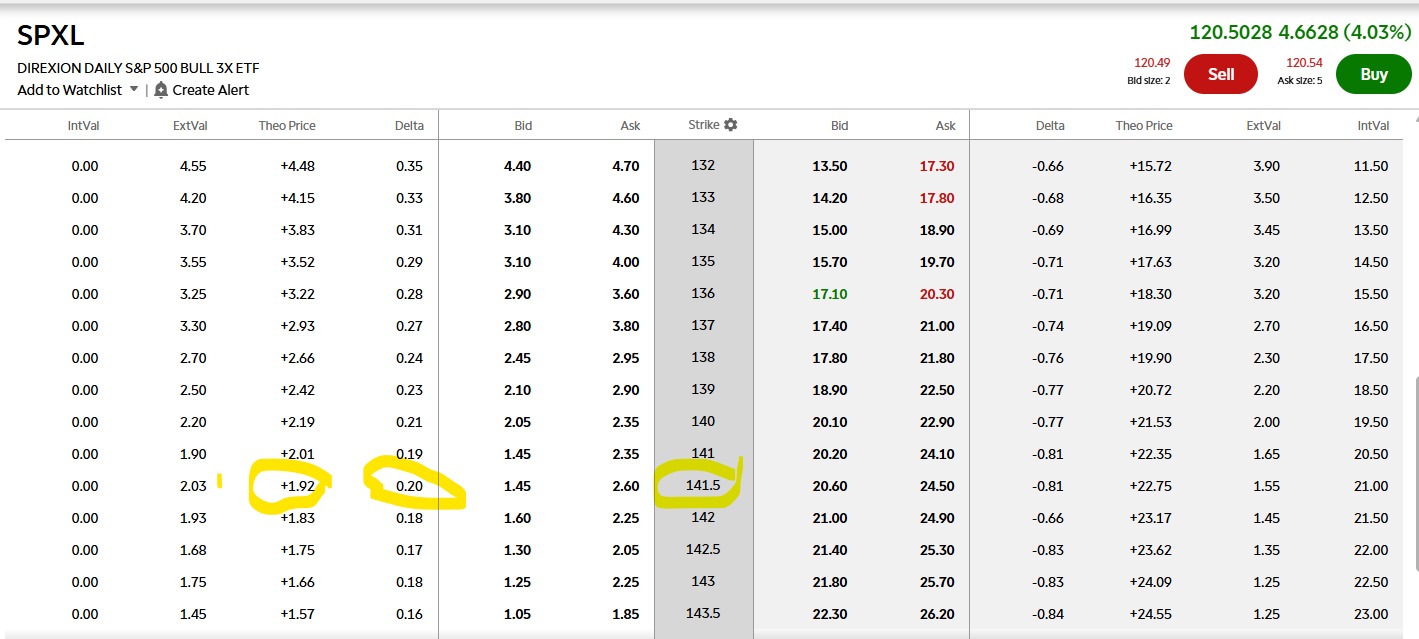

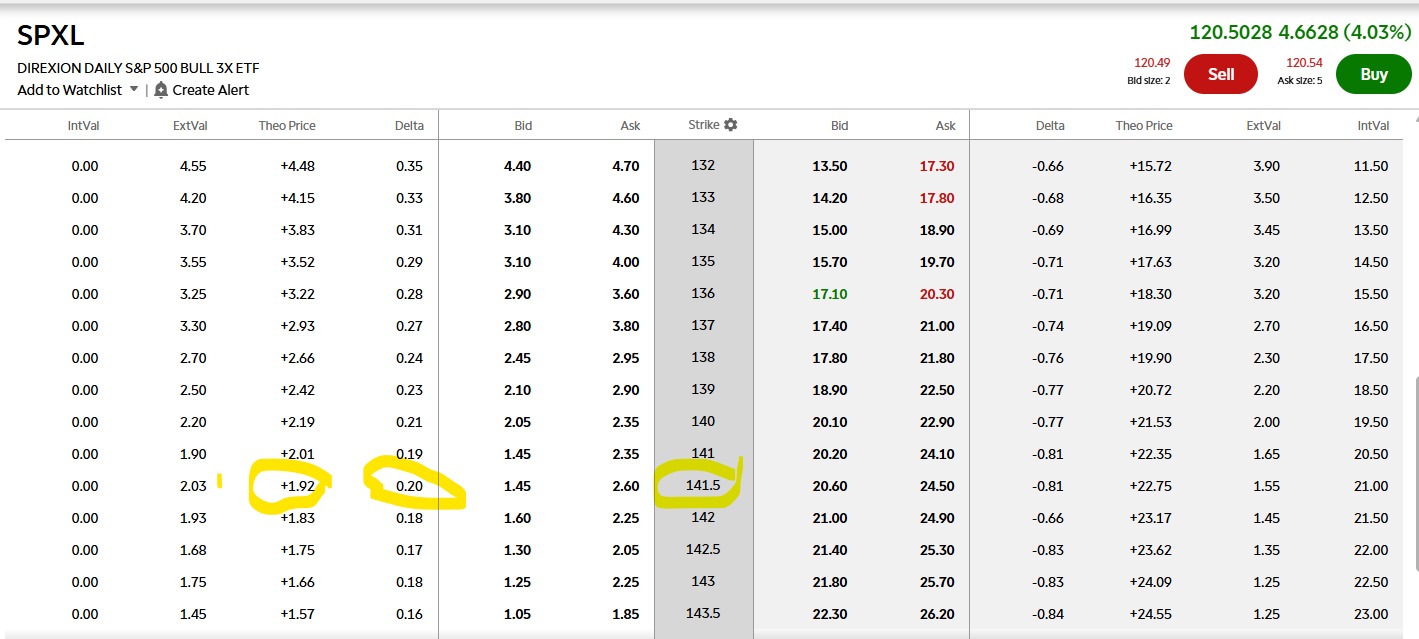

- Let say shares assigned to me. Obviously, my assigned price would be much higher than current price it trades. So I have to write covered call at delta 20 and slowly reach to my assign price to avoid any capital loss.

- At delta 20, just for return on investment comparison, you are getting $2 premium on investment of $141.50. That means in worst case scenario, I will get approximately 1.4% monthly premium. As long as these ETFS exists and don't go to ZERO, the ROI we are getting for the risk we are taking - I am comfortable to invest 10% of my portfolio in these ETFS. The other 90% of my portfolio will be invested in stocks.

- Don't exceed more than 10% of your total portfolio in leverages ETFS. Greater than 10% investment in these etfs will invite for permanent capital loss and more trouble.