Loading…

Please wait while we prepare your analysis

Explore how float, compounding, and disciplined income generation power long-term equity growth — our modern Berkshire-style framework.

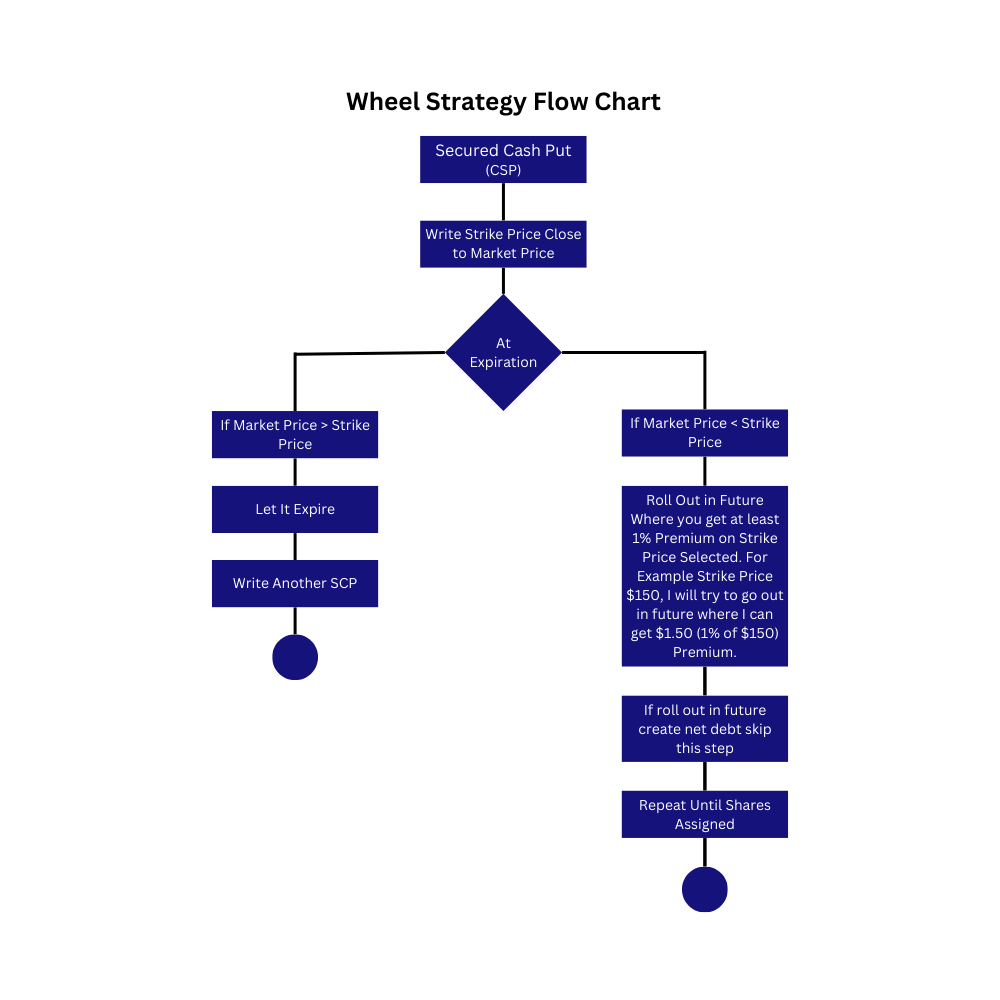

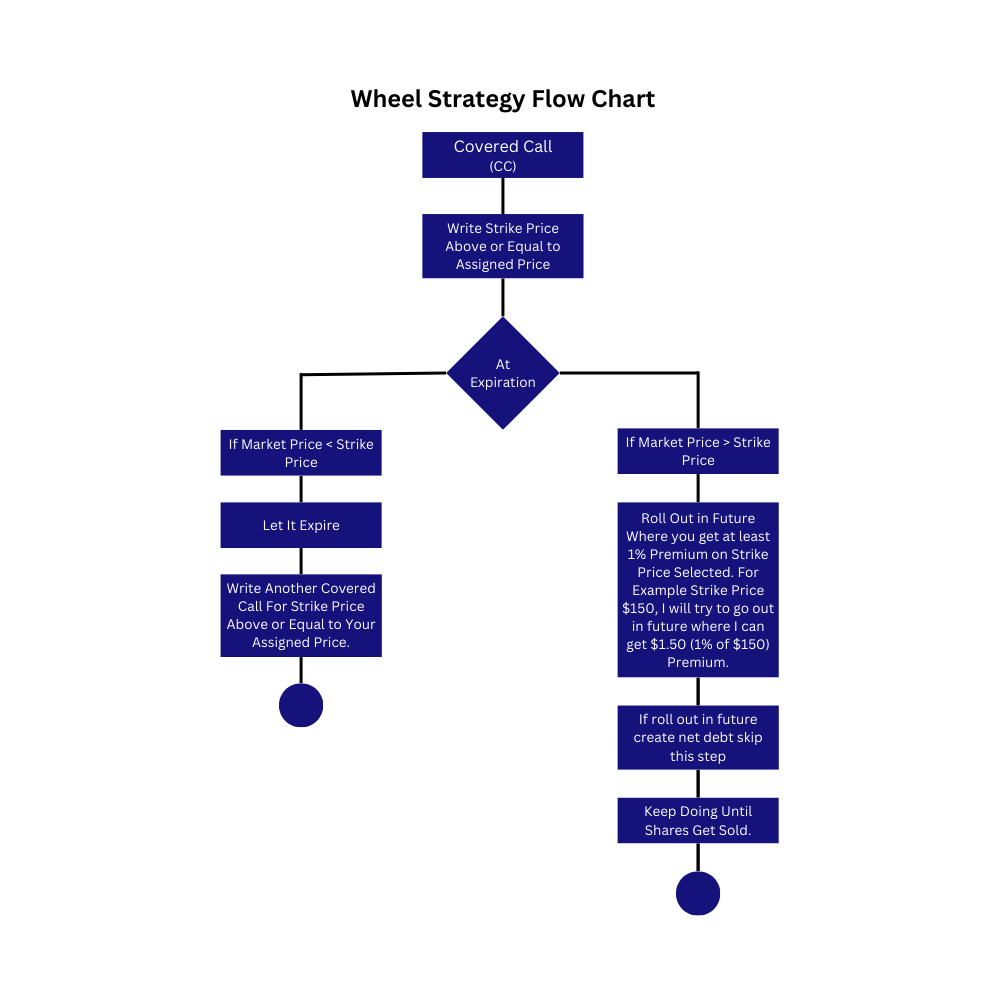

Read the Full Model →Sole Strategy: I exclusively utilize the Wheel Strategy for all trades.